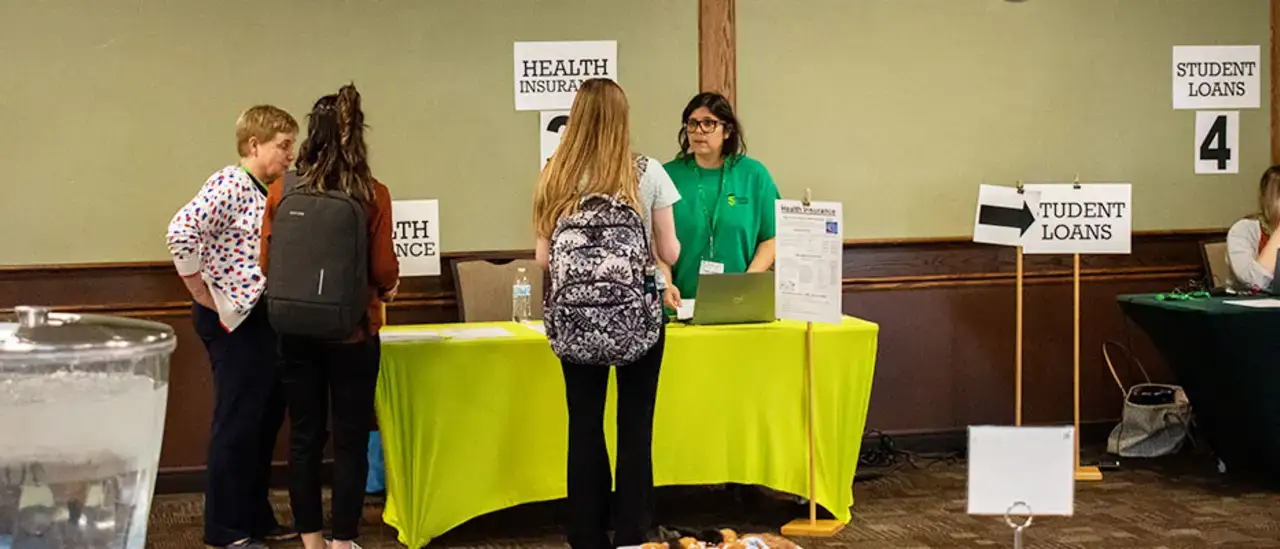

On Monday, Nov. 7, the Making Cent$ Financial Literacy and Wellness Program at SUNY Oneonta held its signature Life After College event, where students can begin creating a realistic budget plan for their post-graduation livelihood. Life After College features nearly two dozen one-on-one conversations between students and campus volunteers who have experience with financial planning. Each discussion focuses on a different aspect of budgeting, such as income tax, housing, debt, groceries, health and wellness, savings, personal care and many more topics.

The biggest takeaway for students? “Save early and stay out of debt,” says Financial Wellness Coordinator Mary Ballard. “The less that you can be in debt, the better. If you get into debt, you’ll have to pay that debt off in some way. Not charging up a big bill is going to help you drastically.”

Making Cent$ of Financial Literacy

Life After College is a great opportunity for students to prepare for their financial future, regardless of when they expect to graduate. Even program volunteers say they often improve their own financial literacy as they help educate students.

“There is a lot of community happening in that room, so the students get a lot of individual attention. I hope that students have a lot of fun during the event and that this helps them not think of finances negatively,” said Ballard. “I’d like to see them plan for their financial futures and be better off than I was when I graduated.”

“Be better off than I was” was a shared sentiment among every volunteer, allowing them to engage each student in conversations aimed at helping them figure out where they would like to go after graduation, visualize their financial goals, and discover ways to create a budget that will help them get there.

“After graduation, you start at a low-entry job and may not make as much money as you expect,” said Suemiled Montanez-Cinpron, a Fashion and Textiles major who plans to work in fashion merchandising. “Just keeping in touch with reality and thinking about how to spend my money is important.”

Suemiled was one of more than 50 students who participated in the Nov. 7 event, held in the Morris Conference Center on campus. She began by establishing her approximate income, based on starting salaries in her field in New York City, where she plans to live. Then, under the guidance of volunteers at each of 17 tables, she factored in costs ranging from income tax, health insurance and student loans to dining, hobbies and personal care.

“I thought coming to this program would be a good way to see what my future might be like and how my spending habits would affect that,” said Evan Waxman, a dual major in Adolescence Education-Social Studies and History. “It was interesting to see how all the little things add up, like going out to eat. I’m definitely going to be cutting back more on that and just going to the dining hall.”

Life After College Debriefing

After finishing the simulation at the “unexpected expense” table, each student sits down with a Student Accounts Office volunteer to see how their post-graduation budget is looking. The debrief discussion includes topics that may not have been accounted for while planning a budget, such as living with parents to save and temporarily offset some expenses.

“Not every student has thought, “Ok, what are my parents currently paying for me? When am I taking that over?”,” said Katie Peters, a Making Cent$ team member. “For example, students may be on their parent's health insurance, and they’ll eventually have to take that over, but when do they plan for that? So, starting right when they graduate, students might have those expenses start occurring very quickly, and then they don’t have the funds set aside.”

“Food and utilities were some of the biggest things I learned about today,” said Suemiled. “I thought the cost of Internet, TV and streaming services was high, as well as heat and electricity. Also, considering other expenses like gift giving and traveling. You see how those can really add up in your budget.”